Top EIDL FAQs - What You Need to Know

Over a million small business owners with SBA COVID-19 EIDL loans are struggling to keep up with repayment and many don’t realize there are legitimate ways to resolve their obligations.

Our Free EIDL Resolution Review can quickly determine your options under SBA rules, explain the process in plain language, and help you take the right next steps to protect yourself and your business. This FREE 30-minute call could change everything!

Most Common Questions

-

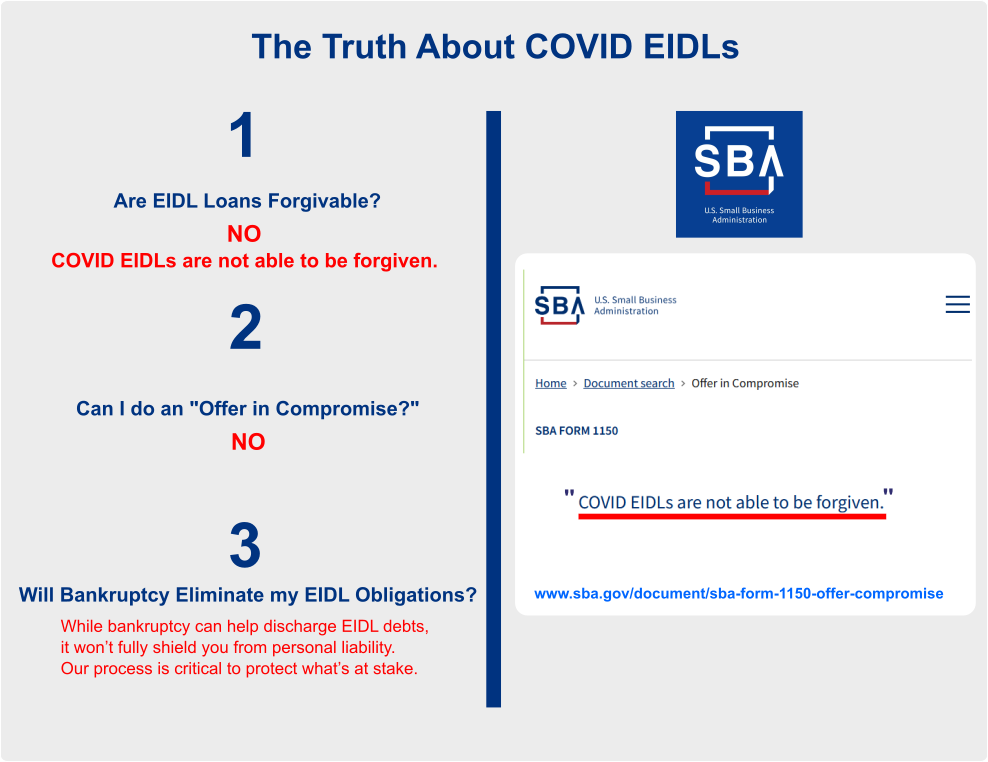

Are EIDL Loans Forgivable?

Unfortunately, this isn’t possible. According to the SBA, “COVID-19 EIDL loans are not able to be forgiven.” This common misconception often comes from confusion with the Paycheck Protection Program (PPP), which did allow forgiveness under certain conditions. The EIDL program, however, is a traditional loan — meaning the full amount, plus interest, must be repaid over 30 years.

While forgiveness isn’t an option, there may be alternative solutions based on your circumstances. We recommend scheduling a Free EIDL Resolution Review with one of our experts to get your questions answered and explore your options.

-

Can I do an "Offer in Compromise"?

No. The SBA clearly states that COVID-19 EIDL loans are not eligible for an Offer in Compromise. While the OIC process is available for certain other SBA loans, it is not an option for COVID-19 EIDLs under current SBA guidelines. This is explicitly noted on the SBA’s official Form 1150 information page.

We understand this can be frustrating for business owners navigating difficult financial situations. In some cases, there may still be ways to close the business and remove personal liability—depending on factors like loan amount and business structure. To see if you qualify, book a Free EIDL Resolution Review.

-

Will Bankruptcy Eliminate My EIDL Obligations?

Bankruptcy may discharge or restructure SBA EIDL debt, but it does not guarantee full relief from liability. The outcome depends on the type of bankruptcy filed, whether a personal guarantee was signed, and whether you’ve complied with an exhaustive list of SBA loan requirements such as:

- Submitting annual financial statements

- Maintaining hazard insurance with the SBA as loss payee

- Not issuing dividends or distributions without SBA approval

- Maintaining accurate books and records

- Avoiding the sale of assets outside the ordinary course of business without SBA consent

And those are just some of the obligations the SBA can hold you to — they represent the tip of the iceberg when it comes to compliance. If any of these were overlooked, bankruptcy may not protect you and could even make matters worse. Because it’s a serious decision with long-term consequences, bankruptcy should only be considered after carefully weighing the financial thresholds and exploring every available option. Our team can help you cut through the complexity, evaluate your specific circumstances, and determine whether bankruptcy — or another strategy — is the right move forward.

-

What Happens if I Default on an SBA EIDL Loan?

Defaulting on your EIDL loan triggers a chain of collection actions. First, the SBA will attempt direct collection. If unsuccessful, the debt is typically referred to the U.S. Department of the Treasury, which can take aggressive action—such as wage and Social Security garnishment, seizure of tax refunds, addition of a 32% collection penalty and/or placing liens on business and personal assets, especially if the loan was personally guaranteed.

A default can severely damage your business credit and, in some cases, your personal credit as well. If you’re struggling to make payments, speak with one of our EIDL experts right away to understand your options and avoid the worst-case scenarios.

-

Do I Have to Pay Back an EIDL Loan?

Yes. All EIDL loans must be repaid under the terms of your loan agreement. These are long-term obligations, over 30 years, at a fixed interest rate of 3.75% for for-profit businesses.

While there is no forgiveness, some borrowers may qualify for strategic closure options that limit personal liability. We specialize in building comprehensive EIDL Resolution packages designed to protect your corporate veil and reduce personal exposure. Schedule a Free EIDL Resolution Call today —many firms charge $500 or more for the same consultation.

Trusted by:

Interested in Learning More?

Schedule a free EIDL Resolution Review

Find out more about the ethical path to resolving your EIDL (in many cases without bankruptcy).

Here’s what happens next:

✅ Step 1 - Free EIDL Review Call

We’ll reach out for a 5-minute initial fact-finding call to determine your situation and schedule your strategy session.

✅ Step 2 - Free EIDL Relief Strategy Session

We'll schedule a no-obligation, 30-minute call with one of our EIDL Resolution Strategists. Understand all your options and you decide the path that is right for you.

Choose a day and time that works for you. Find out how we can help you turn the page and start fresh.

In the event you can't find a date and time that work for you, please call us directly at: (346) 241-3421

The EIDLexit team was great to work with. From my very first phone call with E.J, I immediately felt at ease and that this was the right path to take. Chase and Jackson guided us through the process, were quick to answer any questions, and always made us feel comfortable and confident that they were doing everything possible to help us get through this. Before working with this team, anything EIDL related was a source of frustration, anxiety, and confusion. I don't think we could have found a better team to work with!

When we could no longer pay our EIDL after the business failed, we didn’t know what to do. What a relief to find a solution without filing bankruptcy. The SBA no longer hounds us to pay, pay, pay. Thanks EIDLexit!

We are deeply grateful for your assistance with the SBA. Despite our best efforts, we would still be lost without your guidance. My wife and I are incredibly happy with the results, and we couldn't have achieved this without your support. Thank you from the bottom of our hearts.

I don't know what I would've done without EIDLexit – you guys really saved me! When the SBA was pressuring me with all kinds of threats, you calmly helped me close my business and move on without their worries. You're real lifesavers!

Our Services

Business Closure

We handle all the legal steps to properly close your business so you can move on without worrying about lingering liabilities.

SBA Resolution

We compile & submit a comprehensive resolution package that informs the SBA of the business closure to minimize collection risk.

© 2025 EIDLexit

*EIDLexit offers services and documents created by attorneys on our team, who partner with us, or are contracted by us or our advisory board. In other words, while EIDLexit employs and contracts with licensed attorneys, the company itself is not a law firm. Thus, when specific legal services or counsel are provided, they are delivered by individually licensed attorneys. For specific legal matters that fall outside our or that attorney's area of competence, clients should seek independent legal counsel. Use of our services is governed by our Terms of Use and Privacy Policy.