EiDLexitTM Comprehensive Strategy Session

A structured process incorporating legal guidance, designed to clarify your EIDL options and the implications of each choice.

Table of Contents

Jump to any section below.

- What Is the EiDLexit Strategy Session?

- How the Process Begins

- How We Create CLARITY

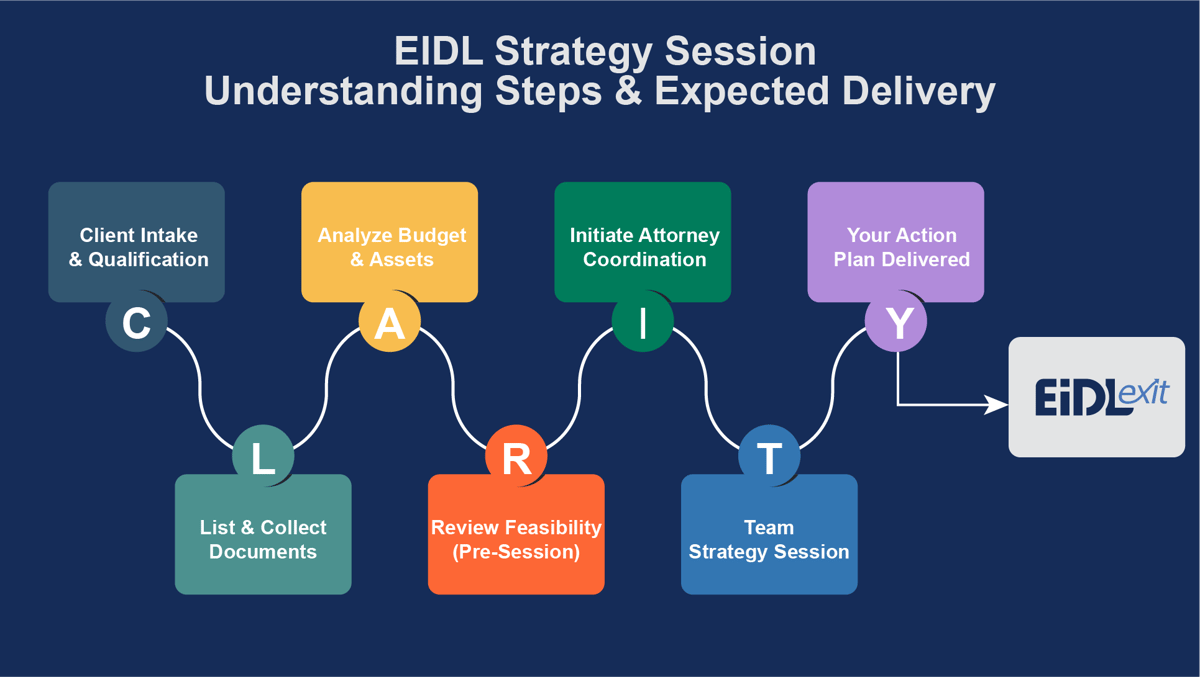

- Understanding the Steps

- Strategy Session Framework

- What the Strategy Session Delivers

- The CLARITY Process Explained

- Who Leads the Process?

- EIDL Resolution vs. the Strategy Session

- What Happens Next

Tip: If you are not sure where to start, begin with How the Process Begins.

What is the EiDLexit Strategy Session?

The Strategy Session exists to help business owners make the right decision at a critical moment. It is not a sales call and it is not a one size fits all solution. Its purpose is to evaluate your situation objectively, with legal context, so decisions are based on facts, timing, and risk rather than pressure or guesswork.

Business owners facing EIDL debt are often told to just file, just close, or just wait. Those shortcuts ignore a critical distinction. Saving a business and exiting a business are fundamentally different objectives, each carrying very different consequences. The Strategy Session replaces uncertainty with a clear action plan that defines your options, the implications of each choice, and the path that best protects you and your assets.

When uncertainty is high and the stakes are real,

C L A R I T Y

becomes the most valuable asset.

How the Process Begins

The process begins with a free call with our team. This call allows us to understand your situation at a high level, answer initial questions, and determine whether a Strategy Session is appropriate for your circumstances.

Not every situation requires a Strategy Session. If it does, we will explain why, outline what it involves, and provide next steps so you can decide how to proceed.

How We Create CLARITY

Clarity does not come from a single conversation. It comes from a structured process that evaluates your objectives, your financial reality, and the legal constraints surrounding your situation.

This process is captured in our CLARITY Framework, a step-by-step methodology designed to ensure decisions are made with full information, not pressure or assumptions.

Next, you will see the CLARITY steps at a glance, followed by a short explanation of what each step means.

The Comprehensive Strategy Session

When resolution alone isn’t enough, we take things a step further. Some situations—such as complex EIDL debt, intertwined business and personal finances, or upcoming bankruptcy considerations—require a deeper, more coordinated approach.

That’s why we developed the Comprehensive Strategy Session: a collaborative process uniting EIDLexit’s resolution experts with seasoned attorneys, accountants, and financial professionals from our national service network. Together, we assess every angle of your situation to build a clear, strategic path forward.

Step 1

Client Intake and Qualification

The process begins with a structured intake designed to surface the real objective, not assumptions. Business goals, debt exposure, and desired outcomes are captured upfront. EIDL loan status is verified, and the underlying intent is clearly defined.

Step 2

List & Document Collection

Financial and operational documents are gathered to establish a complete factual baseline. Budgets, assets, liabilities, and supporting records are reviewed for completeness and accuracy. Any gaps are identified and resolved before analysis begins. No strategy is formed without verified data.

Step 3

Analyze Budget & Assets

A detailed internal financial model is created to reflect real-world operating conditions. Projected cash flow, asset exposure, and debt pressure are mapped to determine what is sustainable and what is not. This analysis forms the foundation for every recommendation that follows.

Step 4

Review Feasibility (Pre-Session)

The analysis is reviewed internally to assess whether continuation of the business is realistic. If the numbers support stabilization, that path is prepared. If the data indicates unavoidable decline, the focus shifts early to exit-based strategies.

Step 5

Initiate Attorney Coordination

Once the financial direction is clear, appropriate local counsel is engaged. Conflict checks are completed, jurisdiction-specific considerations are reviewed, and the strategy session is scheduled only after all prerequisites are satisfied.

Step 6

Team Strategy Session With Attorney

The strategy session is a working meeting, not a consultation. Financial analysis is reviewed, legal options are explained, and risks are clearly outlined. Viable paths are discussed in plain language, including preservation, exit, or bankruptcy-related options when applicable. Next steps are presented based on the selected direction.

Step 7

Your Action Plan Delivered

The outcome of the session is a clear game plan. Options, costs, risks, and recommended actions are defined so decisions can be made with confidence. No commitment is required during the session. The deliverable is clarity and direction, not pressure.

What the Strategy Session Delivers

Certainty of your path forward - backed by analysis, not guesswork.

|

|

The CLARITY Process Explained

The CLARITY framework is the structured process we use to turn uncertainty into an informed decision. Each step is designed to answer a specific question before moving forward, ensuring that choices are made with facts, timing, and risk fully understood.

C – Client Intake and Qualification

The process begins with a structured intake designed to identify your true objective. You will complete a questionnaire outlining your business structure, debt obligations, and desired outcome. At this stage, we confirm whether SBA EIDL debt exists and clarify whether your goal is to save the business, exit the business, or evaluate both paths.

This step prevents early misalignment. Many owners assume they have only one or very limited options, when in reality there may be multiple paths forward. The purpose here is not to reach a conclusion, but to ensure the right questions are being asked before deeper analysis begins.

L – List and Collect Documents

Once intake is complete, we collect the documents required to properly evaluate your situation. This typically includes budgets, asset lists, tax returns, and other financial records relevant to both business and personal exposure.

Our team reviews all submissions for completeness and requests additional information when needed. Decisions made without full documentation create unnecessary risk. This step ensures the analysis that follows is based on verified information rather than estimates or assumptions.

A – Analyze Budget and Assets

Using the information provided, our team builds a detailed financial analysis mapping your income, expenses, assets, and liabilities. This analysis allows us to evaluate feasibility across multiple scenarios, including continuation of the business or a structured exit.

The goal is to determine whether the business can realistically be saved or whether exiting the business better protects you long term. This analysis becomes the foundation for the Strategy Session discussion and removes emotion from the decision making process.

R – Review Feasibility Pre Session

Before the Strategy Session occurs, your financial analysis is reviewed internally to assess feasibility. If the numbers support continuation, we prepare to discuss preservation or restructuring options. If saving the business is not viable, the focus shifts to an exit strategy designed to reduce exposure and protect personal assets.

This review ensures the Strategy Session is focused and productive. You are not paying for speculation. You are walking into the session informed by analysis.

I – Initiate Attorney Coordination

Once feasibility is confirmed and documents are complete, we coordinate with appropriate state specific legal counsel. This includes conflict checks and scheduling the Strategy Session with an attorney who can provide jurisdiction specific guidance.

Attorney coordination at this stage ensures legal considerations are addressed at the right time, rather than after decisions have already been made.

T – Team Strategy Session

The Strategy Session is conducted with both the EiDLexit team and the attorney. During this meeting, we review your financial analysis, discuss available paths forward, and answer your most pressing questions.

Based on your situation, we outline options related to saving the business, exiting the business, EIDL resolution, or personal bankruptcy coordination. Pricing and next steps are discussed only after clarity is achieved.

Y – Your Action Plan Delivered

During the Strategy Session, you receive a clear and actionable plan outlining your viable options, recommended direction, expected timing, and associated costs.

There is no obligation to proceed after the session. The value of the Strategy Session is certainty. You leave with clarity on your path forward and the information required to make a confident decision.

The outcome of the CLARITY process is certainty about your next step.

Who Leads the Process?

The Strategy Session is one component of a larger, structured process led by EIDLexit. We design and manage the framework that surrounds your case from beginning to end, including intake, document collection, financial analysis, feasibility review, and preparation. This structure ensures that decisions are made in the correct sequence and based on complete, organized information rather than assumptions or fragmented advice.

The attorney’s role is intentional and focused within this process. Before the Strategy Session takes place, all relevant documentation is collected, organized, and analyzed, and a complete packet is prepared and provided to the designated local attorney for review. This allows the attorney to become familiar with the facts of your situation in advance and confirm that the necessary information is in place to support a productive session.

By the time you reach the Team Strategy Session, the attorney is already oriented to your situation and can focus on legal interpretation, guidance, and implications during the meeting itself, rather than spending time reconstructing background details. The Strategy Session then serves its intended purpose: applying legal insight to a fully developed situation so you can move forward with confidence in the direction being recommended.

Legal guidance is provided through licensed attorneys within EiDLexit's professional service network.

EIDL Resolution and the Strategy Session: Understanding the Difference

EIDL resolution and the Strategy Session serve different purposes. The Strategy Session is designed to assess your situation, clarify your options, and determine the most appropriate path forward. EIDL resolution is one possible outcome of that process, but it is not assumed, automatic, or appropriate in every case.

EIDL forgiveness is often misunderstood. The SBA clearly states "COVID EIDLs are not able to be forgiven."

During your free call, we determine whether resolution alone, a Strategy Session, or a combination of both may be appropriate based on your situation.

What Happens Next

This is a lot to take in, and that is intentional. Decisions involving EIDL obligations, business continuity, or exit planning are rarely simple and should not be rushed. The purpose of this page is to give you a grounded understanding of how the process works and what decisions need to be made before moving forward.

The next step is a free call with our team. This conversation allows us to understand your situation at a high level, answer initial questions, and determine whether a Strategy Session makes sense for you. From there, you can decide how you want to proceed, knowing the options have been thoughtfully considered and the path forward has been outlined in a responsible, informed way.